Keywords: Trust, Discretionary Trust, Discretionary Trusts, Trusts, Trust Establishment, Trust Establishments

Question

How can I establish a Discretionary Trust in NowInfinity?

Answer

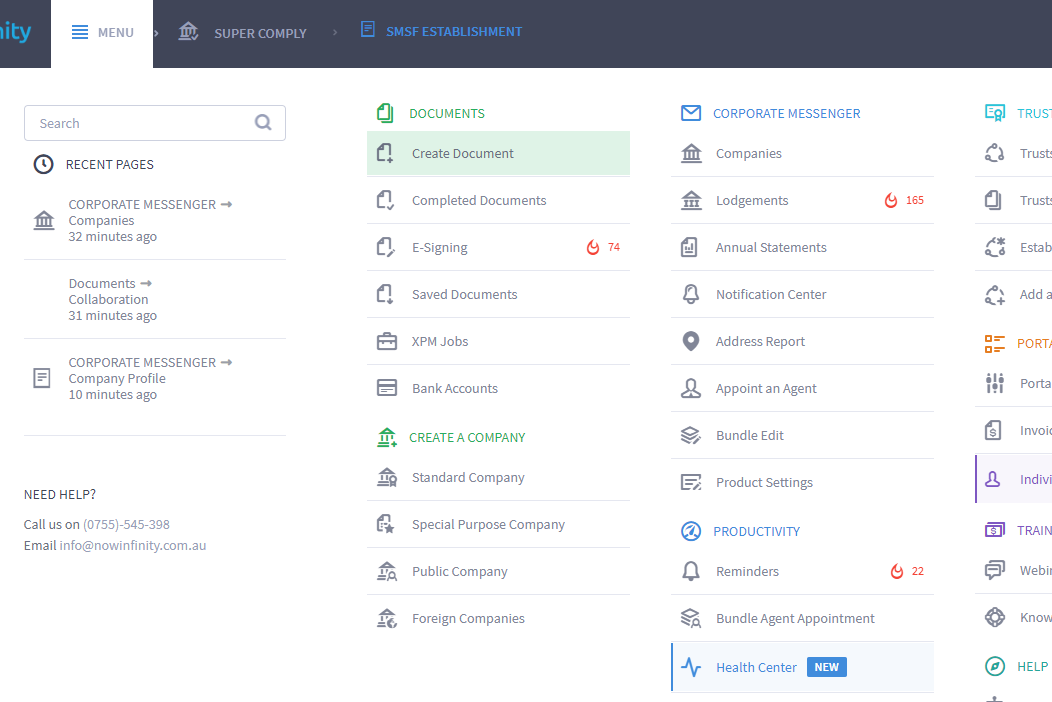

Navigate to Menu > Documents > Create Documents > select "Discretionary Trust"

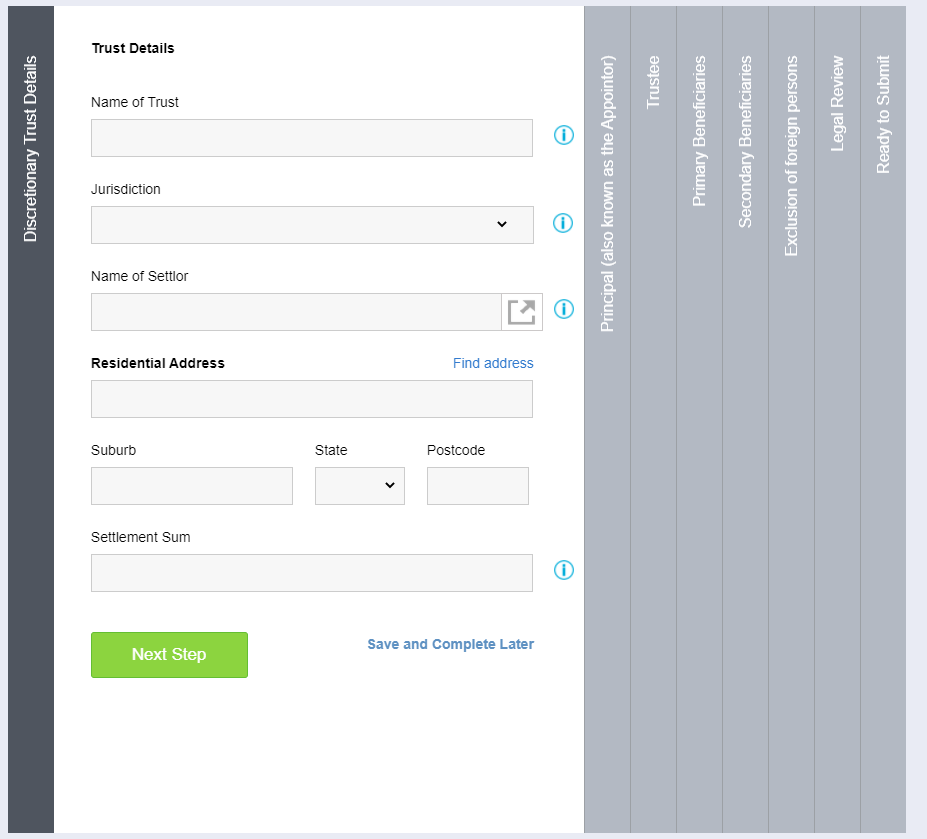

Step 1: Enter the name of the Trust, Jurisdiction, Name of the Settlor, Address and Settlement Sum.

Name of Trust

Must not end with the words Pty Limited. The Trust name does not have to include the word “Trust”, but usually does.

Jurisdiction

The Jurisdiction of law that is to apply is normally the State or Territory where the Trustee and other parties who sign the deed are located and where the deed is signed. You should obtain legal advice if you are unsure.

Name of Settlor and Address

The Settlor must satisfy the following conditions:

- The Settlor is not a Beneficiary nor related to ANY Beneficiary of the Trust

- The Settlor is 18 years of age or over and has consented to their appointment

- The Settlor is not the Appointor

- The Settlor is not the Trustee

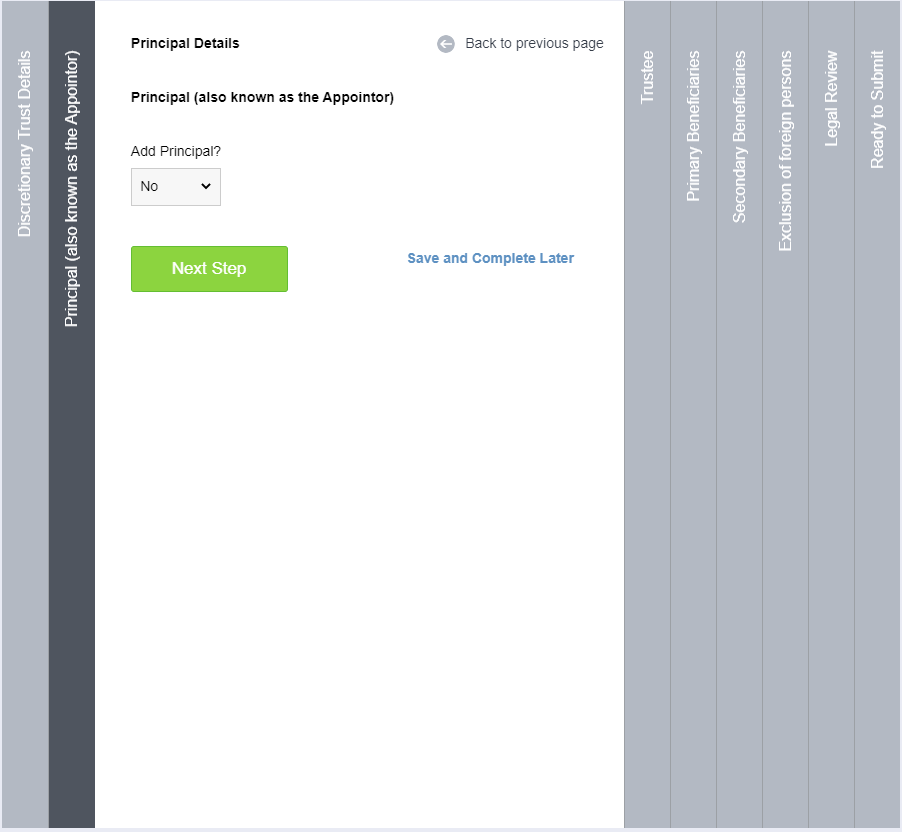

Step 2: Enter the name of the Principal/Appointor - this is optional

You may only add one or more Individual Appointors. All Individual Appointors must be 18 years of age or over.

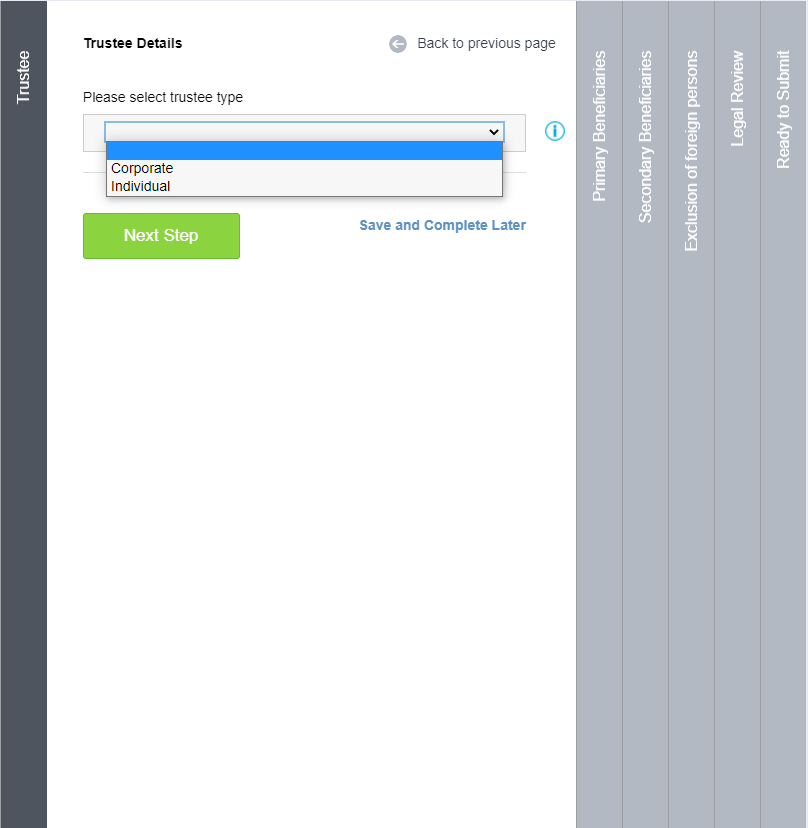

Step 3: Enter the details of the Trustee.

You may only add Individual or Corporate Trustees, not a combination of both.

All Individual Trustees must be 18 years of age or over.

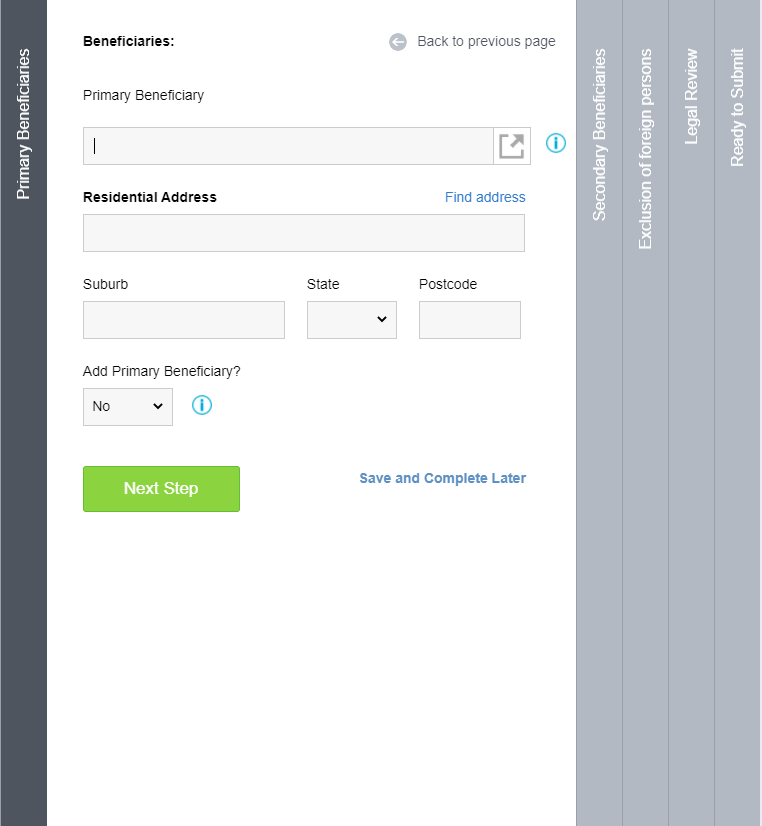

Step 4: Enter the Beneficiary details. You must name at least one Individual (not corporate) Beneficiary.

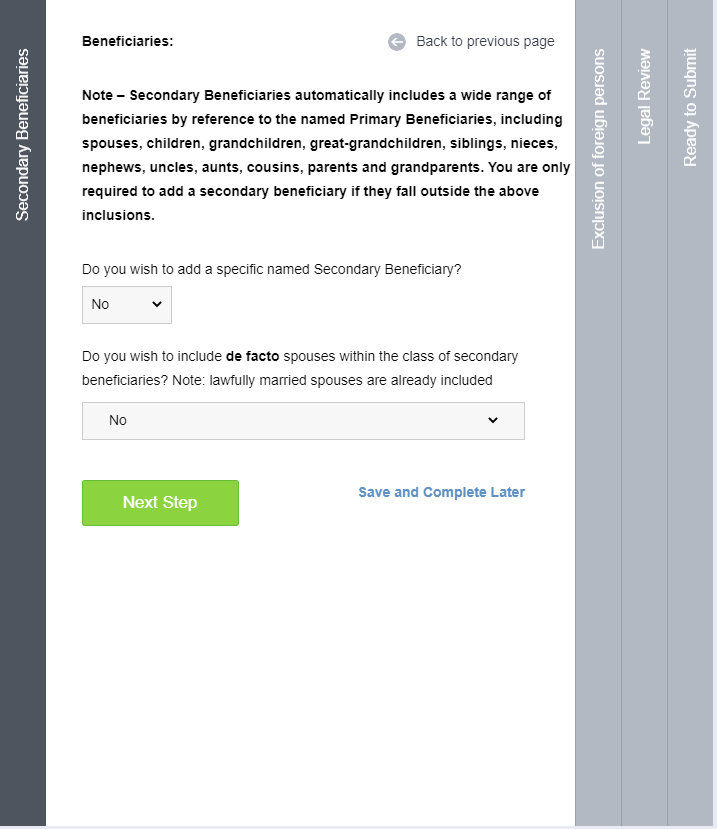

Step 5: Choose if you would like to include a Secondary Beneficiary

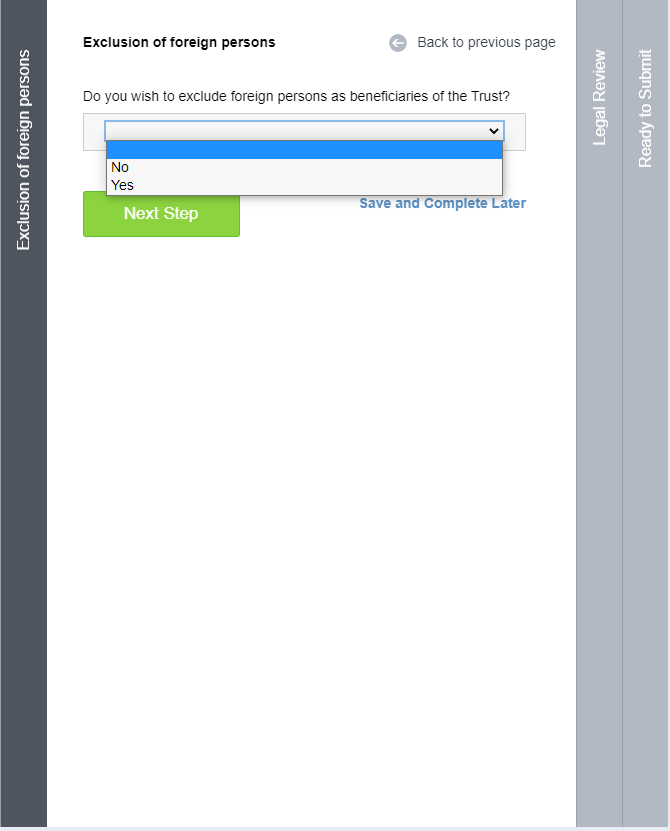

Step 6: Choose if you would like to Exclude Foreign Beneficiaries.

If you choose option ‘Yes’, a popup will appear outlining the structure of the deed, you must click "Understood and Agree" to continue.

Step 7: Legal Review - select what tier of Client Legal Review you would like, if any.

Step 8: Presentation - Select if you would like a printed copy of the documents.

Step 9: Stamping - Select if you would like NowInfinity to stamp the deed.

Step 10: Ready to Submit - Click the "Complete" button to finish.

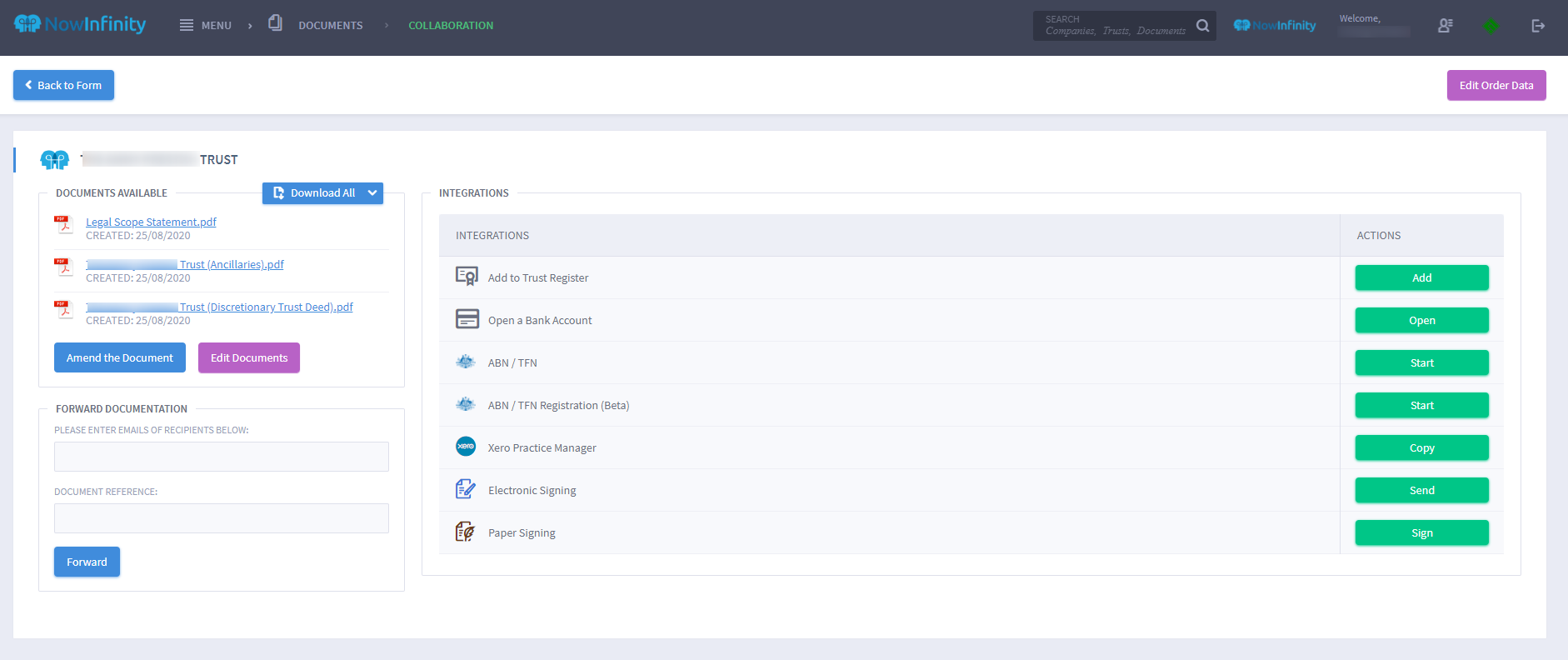

If not on a subscription package, you will be directed to the payment page to make a payment and then to the Collaboration page where you can access the documents and integration options.

Disclaimer: You acknowledge and agree that our Services and Materials do not constitute or contain personal or general advice for the purpose of the Corporations Act 2001 (Cth) and that we, our employees and advisers do not offer any legal, accounting, tax or other professional advice or services in connection with the provision of our Services and any Materials.