Keywords: Beneficiaries, Designated Beneficiary, Corporate Beneficiary, secondary, Company, Trusts

Why do our Deeds refer to "Designated Beneficiaries"?

Why is it that NowInfinity deeds do not require Companies or Trusts to be mentioned in the Schedule?

What is a "Beneficiary"?

A unique characteristic of a Trust is that it effectively permits ownership of the property to be divided between its legal and equitable (or beneficial) ownership.

The Beneficiary of the Trust has beneficial ownership over the Trust property - essentially, it is for their benefit that the Trust has been created and administered.

In saying this, Beneficiaries in a Discretionary/Family Trust do not have a fixed entitlement to trust assets - it is the Trustee who has the discretion to determine which of the Beneficiaries receive Trust assets and how much. However, this discretion is limited by the provisions of the Trust Deed.

As such, the Trustee(s) of the Trust has legal title in Trust property but they owe equitable obligations to the Beneficiary as set out in the Trust Deed.

Beneficiaries of a Discretionary Trust, for example, can be classed as either Primary or Secondary Beneficiaries:

- Primary (or Specific/Designated) Beneficiaries are those named explicitly in the Trust Deed.

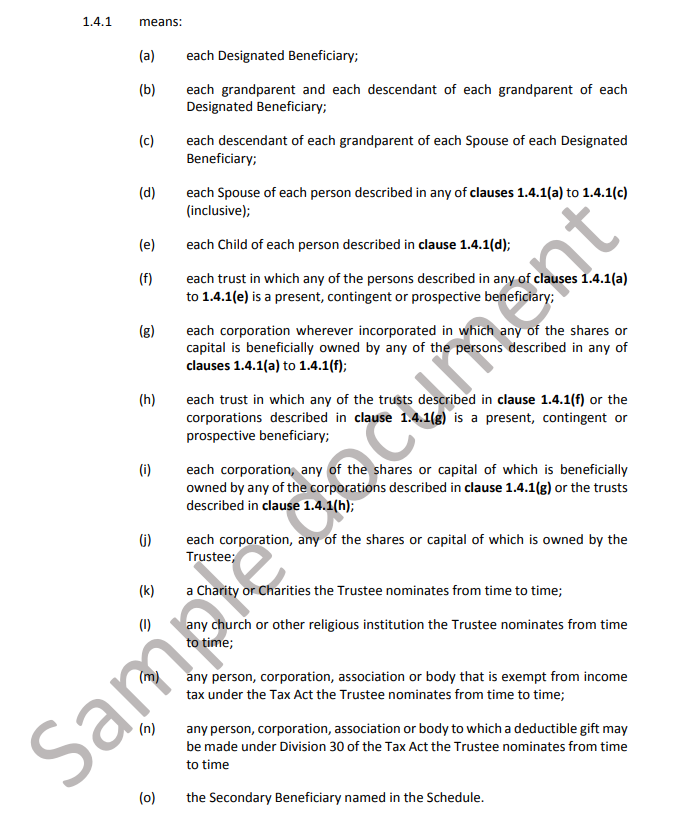

- Secondary (or General) Beneficiaries are ascertained by their relationship to the Primary Beneficiaries in the NowInfinity Deed. This includes certain family relatives, Companies, Trusts and charitable organisations.

Here is a screenshot of how 'Beneficiaries' are defined in the NowInfinity Deed:

NOTE:

-

- There is no requirement to name Secondary Beneficiaries - this section can be left blank. If, however, an individual does not qualify as a Secondary Beneficiary under the Deed (e.g. they do not bear any of the relevant connections above with the Primary Beneficiary) but you would like them to be included within the pool of potential Beneficiaries, then they may be a named Secondary Beneficiary.

-

Corporate Beneficiaries - the Beneficiaries clause in our Trust deed template automatically includes a Corporate Beneficiary in the following circumstances:

- the Primary Beneficiaries are owners of shares in the Company;

- spouse or descendants of the Primary Beneficiaries are owners of the shares in the Company;

- Primary Beneficiaries or their descendants are Beneficiaries of a Trust that owns shares in the Company.

Some Trusts do not stipulate different categories of Beneficiaries. For example, in a standard Unit Trust Beneficiaries will simply be "Unitholders".

As always, refer to the specifics of your Trust deed when identifying the Trust's Beneficiaries.

Who can be a "Beneficiary"?

Our document supports individual Primary/Designated and Secondary Beneficiaries, and entities such as Companies, Trusts, charities/churches as Secondary Beneficiaries.

Note: The Trustee can also be a Beneficiary of the Trust, but only if the trust has more than one Trustee - you can never have a sole Trustee and sole Beneficiary being the one person. See here for further information: Who are the parties to a Discretionary Trust?

Why do our Deeds refer to "Designated Beneficiaries"?

Our Trust deed coins the term "Designated Beneficiary" - this is the Primary Beneficiary (or Beneficiaries) named in the Schedule or the Trust Deed.

The Designated Beneficiary may, by default, receive an automatic distribution of Trust assets in a situation where the Trustee has not exercised its power under the Trust to distribute all trust assets by the end of the Vesting Date.

Why is it that NowInfinity deeds do not require Companies or Trusts to be mentioned in the Schedule?

Often, we find that clients do not actually need to specify Companies, Trusts & charitable organisations as Beneficiaries in the Schedule because they may already be included by virtue of the Beneficiaries definition (as provided above).

Further Information

Can I Exclude Foreign Beneficiaries when establishing a Discretionary Trust?

Who are the Default Income and/or Capital Beneficiaries?

How to amend a Trust's Beneficiaries

Disclaimer: You acknowledge and agree that our Services and Materials do not constitute or contain personal or general advice for the purpose of the Corporations Act 2001 (Cth) and that we, our employees and advisers do not offer any legal, accounting, tax or other professional advice or services in connection with the provision of our Services and any Materials.