The "Deed of Variation (Exclude Foreign Beneficiaries)" service will vary an existing Discretionary Trust to implement the provisions which expressly and irrevocably exclude any "foreign person" from benefiting from the Trust.

You may consider excluding "foreign persons" as potential Beneficiaries to ensure the Trust (or rather, the Trustee of the Trust) will not potentially incur foreign surcharges. You may wish to refer to the relevant state revenue office for further information.

Note: Each jurisdiction imposes separate requirements and the deed of variation does not address the following matters, which should be considered on a case by case basis (with specialist advice sought where appropriate):

- the NSW provisions include a requirement that any Named Beneficiaries who are foreign residents are expressly removed as Named Beneficiaries. Whilst the deed of variation removes foreign residents as a class of potential Beneficiaries, it does not expressly remove any Foreign Named Beneficiaries;

- the Queensland provisions require that any non-resident default Beneficiaries are excluded from the Trust. The removal of Default Beneficiaries is a dutiable transaction in Queensland and the deed of variation should not be used unless the duty consequences have been first addressed;

- in Queensland, the Revenue/Stamps Office retains the ability to both exempt a Trust otherwise caught by the rules and reassess a Trust which had otherwise not been previously caught (within certain time frames).

The Deed of Variation is not designed to be used if any of the Designated/Named Beneficiaries are foreign persons or if any of the parties involved in decisions regarding the administration of the Trust (e.g. as a director of the corporate Trustee or as appointor) are foreign persons.

Note: You must consider the original Trust deed, as well as each subsequent deed amending/varying the terms of the Trust, in determining whether it would be appropriate to use this document.

Document Form

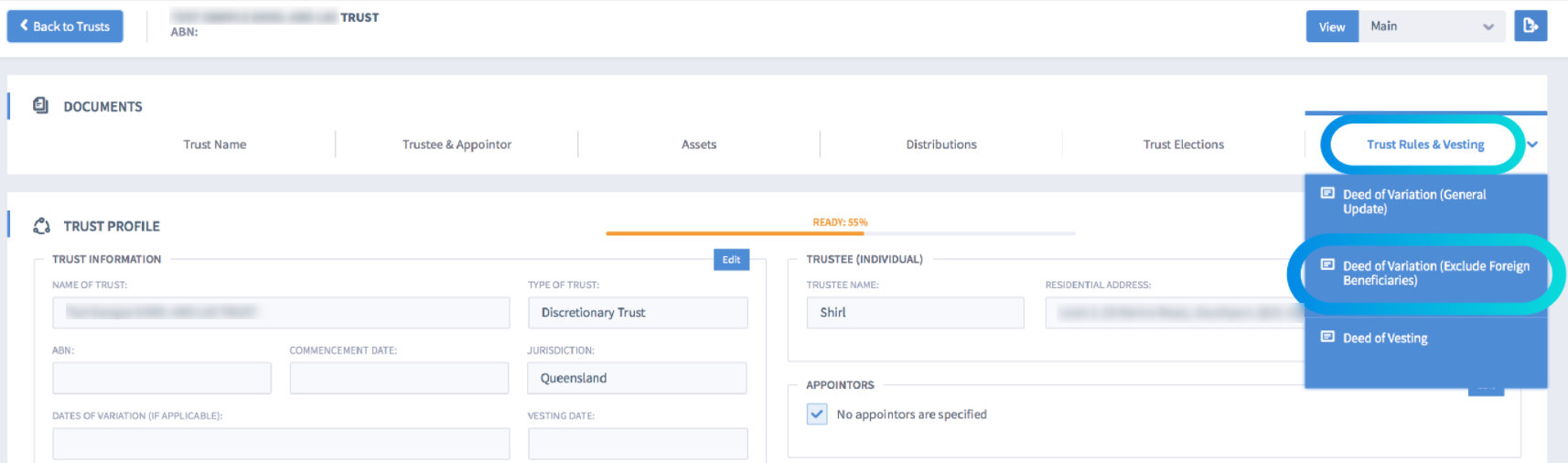

Navigate to the "Trust Register"

- Click on "Trust Rules & Vesting"

- Click on "Deed of Variation (Exclude Foreign Beneficiaries)"

- You will then be redirected to the relevant document form. This form will be pre-filled with any relevant data that has been added or imported into the Trust Profile of the Trust.

- Complete any data that has not been pre-filled. These data fields will be highlighted in pink. You cannot submit the document form until all relevant data fields have been completed.

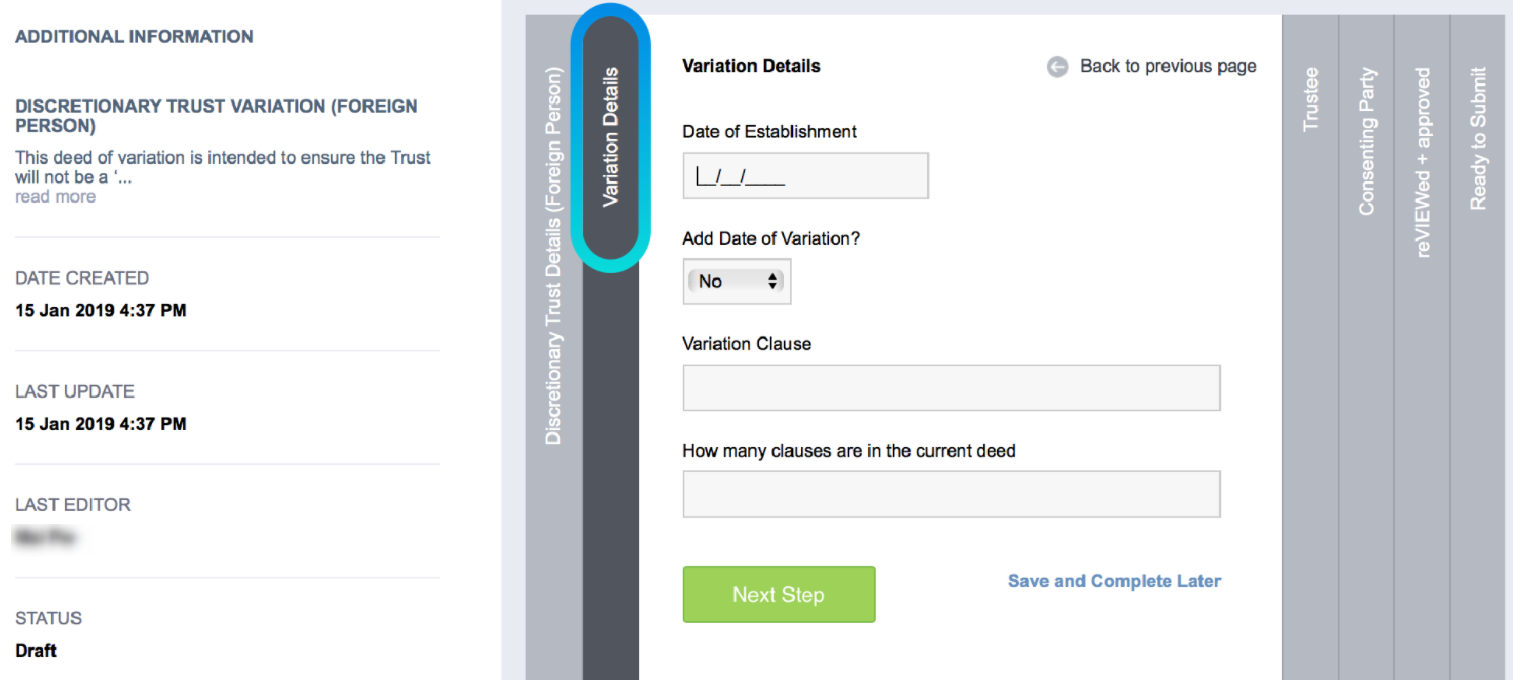

Information to be completed in the "Variation Details" tab

The following information needs to be completed in the "Variation Details" tab

- Date of establishment – This is the date at which the original deed was established/executed. It will be pre-filled if entered previously into the Trust Profile.

- Add date of variation - By answering 'yes', you are confirming that the deed has been varied before. You will need to enter the dates for these prior variations. If you answer 'no', no additional fields will appear.

- Variation clause - This refers to the clause number for the clause in the most current Trust deed (i.e. the original deed or most recent deed of variation) that provides the Trustee with the relevant power to vary the Trust deed.

- How many clauses are in the current deed? - This question is asking for the total number of clauses in the current Trust deed.

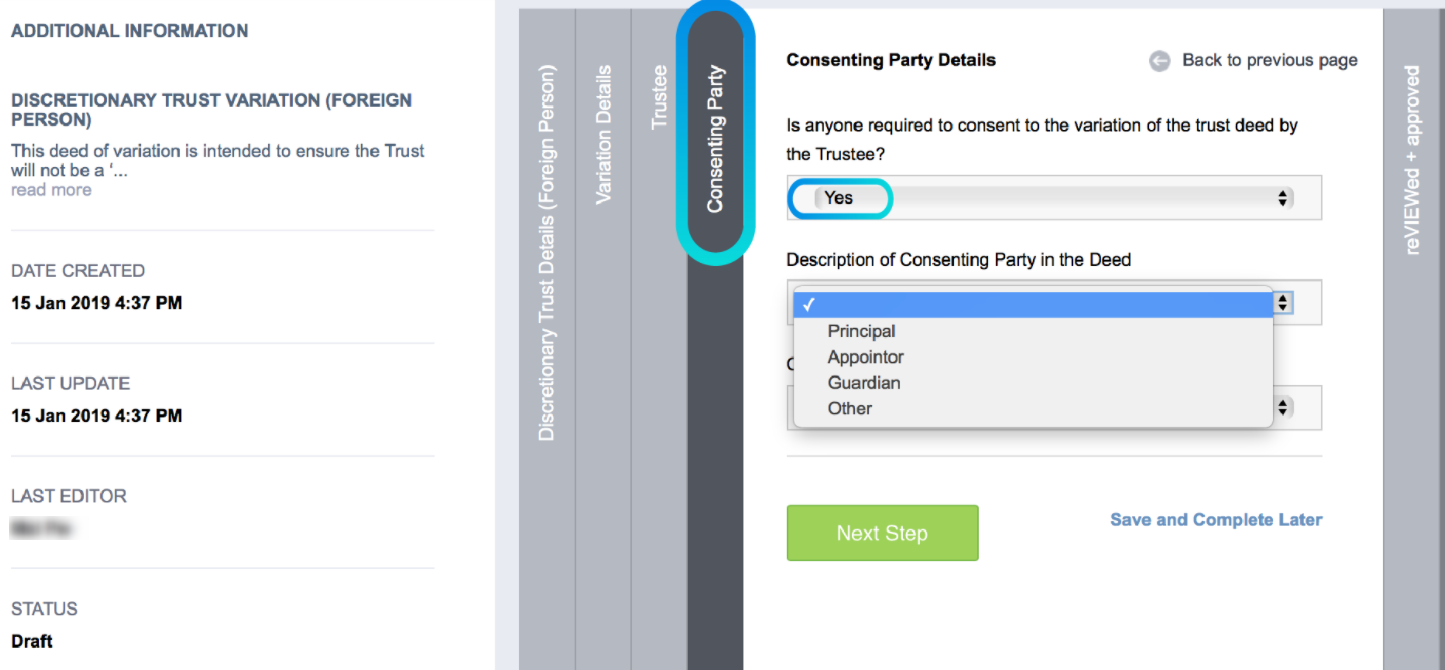

Question to be answered in the "Consenting party" tab

In the "consenting party" tab, you will be asked the following question:

Is anyone required to consent to the variation of the Trust deed by the Trustee?

You will need to refer to the provisions of your Trust deed to answer this question.

If the answer is "Yes", a dropdown box will appear listing the following options:

- Principal

- Appointor

- Guardian

- Other - if you select 'Other', an additional 'Description of Consenting Party in the Deed' will appear. Please enter in the relevant details for the consenting party.

Note: If you are not 100% comfortable in using this form or you do not plan to engage your own solicitor then we recommend you add on legal review to your order.

Further Information

Can I Exclude Foreign Beneficiaries when establishing a Discretionary Trust?