In most cases, the Trust Deed will stipulate the vesting (i.e. termination) date of the Trust or have a provision that defines how a vesting date may be determined. This is the date at which the Trust will end i.e. where the beneficial interests in the Trust assets become fixed.

The Trust Deed will determine what needs to be done in relation to vesting the Trust. For example, the Trust Deed may direct that, on the vesting date, the Trustee is to end the Trust by distributing Trust property to particular Beneficiaries.

It is always recommended to seek specialist legal advice before vesting a Trust to make sure there will be no tax or duties implications upon vesting. Before using this document, it is also important to consider the original Trust Deed, as well as each subsequent amending deed.

The document can be located either through:

- The Trust Profile: Menu > Trust Register > Trusts > Select the appropriate Trust > Trust Rules & Vesting > Deed of Vesting

- Create Documents: Menu > Documents > Create Documents > Trusts > Vesting of a Discretionary Trust.

Note: The Trust's details will not pre-fill using this option

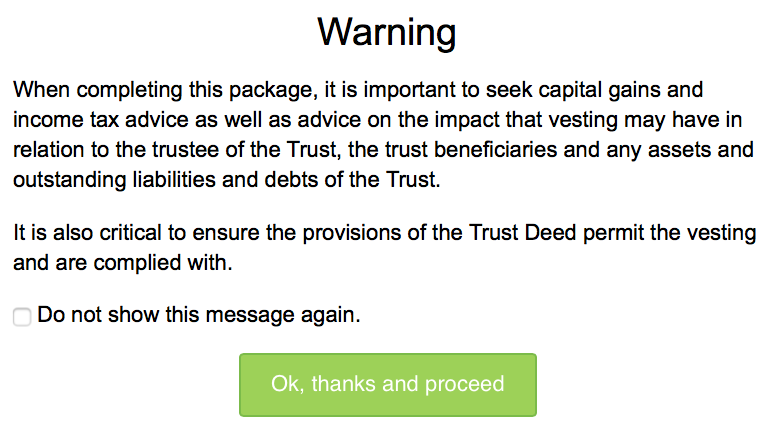

A warning box will initially appear stating the importance of understanding any potential tax implications and the terms of the Trust Deed.

You will need to acknowledge this warning before being able to proceed.

You will then be redirected to the relevant document form. If creating the document through the Trust Profile, the form will be pre-filled with data that has currently been added or imported into the Trust Profile. You will need to complete any data that has not been pre-filled - these data fields will be highlighted in pink.

Note: You cannot submit the document until all relevant data fields have been completed.

On the "Trust Details" tab, you will be asked the following questions:

- Date of establishment – this will be pre-filled if previously entered into the Trust Profile.

- Add date of variation? -

- If you answer "Yes", enter in dates for any prior variations that have been made to the original Deed.

- If you answer "No", no additional fields will need to be answered

On the "Consenting Party" tab, you will be asked the following question:

"Is anyone required to consent to the vesting of the Trust Deed by the Trustee?" - this refers to the most current Trust Deed to answer this question and whether there is a consenting party.

If the answer is "Yes" to this question, a dropdown box will appear listing the following options:

- Principal

- Appointor

- Guardian

- Other - once selected, an additional "Description of Consenting Party in the Deed" field will appear for manual input.

On the "Beneficiary" tab, you will be asked the question as to whom will benefit from the remaining assets of the Trust (both income and capital). This document assumes the remaining assets will be distributed to the Beneficiaries nominated, in equal shares as tenants in common. If an unequal distribution is required, the deed will need to be amended to address that issue.

After submitting the details, the relevant documentation will appear on the "Collaboration page":

- Deed of Vesting and Winding Up Ancillaries (i.e. Trustee Resolution)

- Deed of Vesting & Winding Up

- Legal Scope Statement

Once the "Deed of Vesting & Wind Up" documents have been signed by the client, you will need to either change the status on the Collaboration page ("Paper signing" option) or on the Trust Profile (mark as "Signed"). The Trust Profile will then be updated with the relevant vesting date and you will not be able to create any further documents for this Trust.

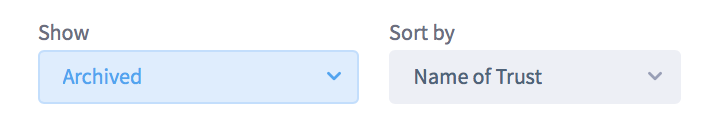

The Trust will also be removed from the active list of Trusts and added to the archived folder, available under "Show" > "Archived".